Understanding AI in the Insurance Industry

Artificial Intelligence (AI) has emerged as a transformative force across various sectors, with the insurance industry being one of its significant beneficiaries. At its core, AI encompasses a range of technologies that enable machines to mimic human intelligence, primarily through data analysis, pattern recognition, and decision-making processes. In insurance, AI is primarily employed to enhance risk assessment, bolster operational efficiency, and create more tailored insurance products.

One of the most pivotal applications of AI in the insurance sector is machine learning, a subset of AI that enables systems to learn from data and improve over time without explicit programming. This technology is instrumental in assessing risk. By analyzing vast amounts of data—ranging from historical claims to individual consumer behavior—insurers can better predict potential risks associated with policyholders. This method not only allows for a more precise underwriting process but also assists in premium calculation, potentially resulting in lower costs for consumers who present a lower risk profile.

Data analytics also plays a predominant role in claims processing. Through the application of AI algorithms, insurance companies can streamline their claims handling procedures, significantly reducing the time it takes to resolve claims. Automated systems can analyze claims data to identify fraudulent activities or inconsistencies, thereby enhancing the accuracy and reliability of the assessment. This efficiency is not only beneficial for insurers but also significantly improves the customer experience, as claims can be processed more quickly and transparently.

Additionally, AI facilitates the development of personalized insurance products tailored to individual needs. By leveraging sophisticated algorithms, insurers can analyze various factors affecting a customer’s profile, allowing them to offer coverage that aligns closely with specific requirements. This level of customization can lead to increased customer satisfaction and loyalty, further cementing the place of AI in the evolution of insurance practices.

Risk Assessment: The Role of AI

The integration of artificial intelligence (AI) into the insurance industry has fundamentally transformed the methodology of risk assessment. By leveraging advanced algorithms and machine learning technologies, insurers can now enhance their ability to evaluate risks more accurately than traditional methods allow. AI methodologies employ sophisticated data collection techniques that aggregate information from diverse sources, encompassing social media, IoT devices, historical claims data, and more. This vast array of data enables insurers to create a holistic view of potential risks associated with policyholders.

One of the pivotal advantages of AI-driven risk assessment is predictive modeling. By analyzing patterns in historical data, AI systems can forecast future claims with remarkable precision. This forward-looking capability not only aids insurers in determining premium rates but also contributes significantly to optimizing underwriting processes. Automated underwriting powered by AI reduces the time taken to evaluate applications, allowing for swifter decisions while maintaining nuanced assessments based on individual risk profiles. As a result, this leads to the offering of tailored insurance products that cater specifically to the needs and behaviors of insured individuals.

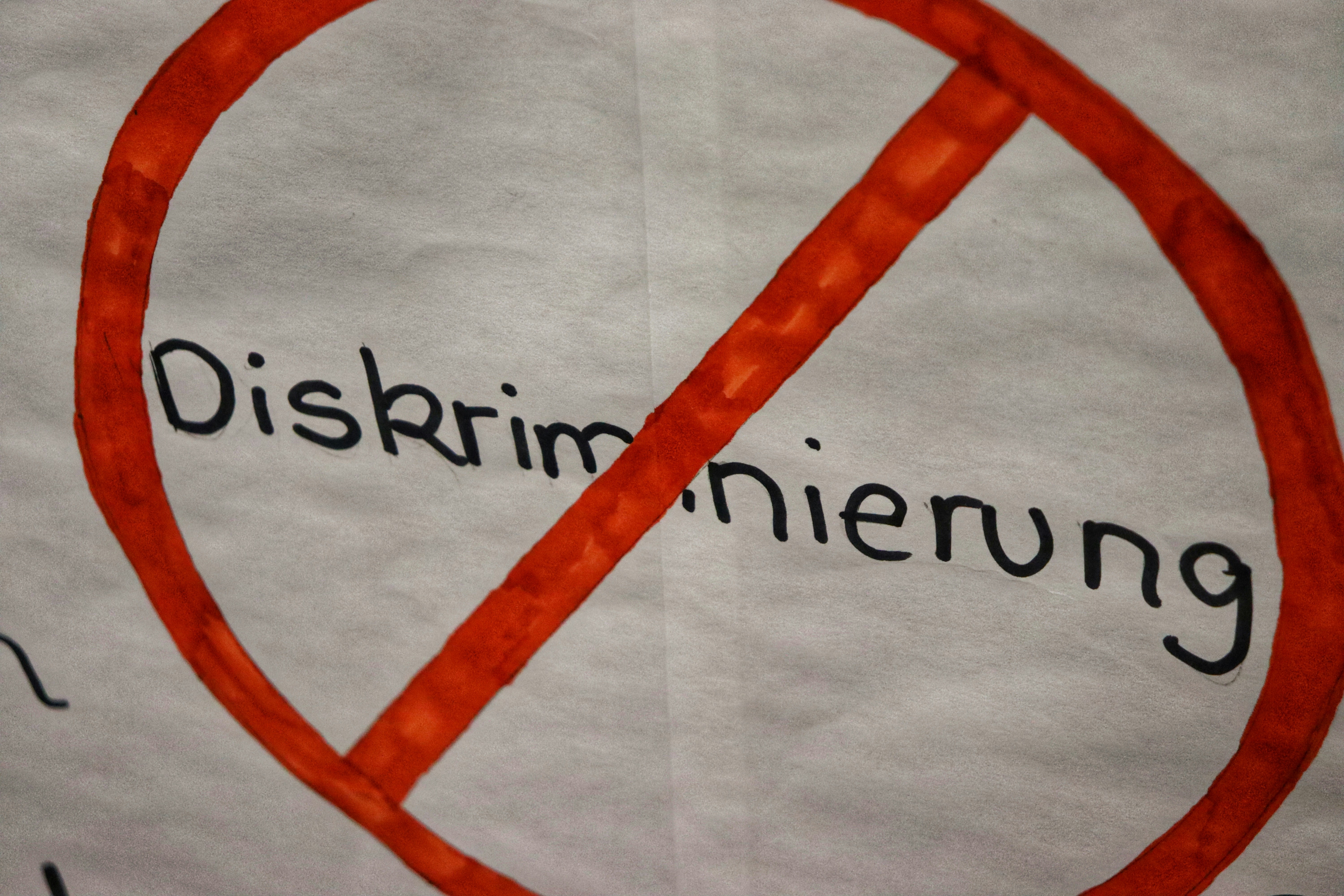

However, the utilization of AI in risk assessment is not without its challenges. One prominent concern revolves around the potential for biases inherent in the data and algorithms. Since AI models are trained on historical data, there is a risk that they may inadvertently perpetuate existing biases present in that data. This raises important questions about fairness and discrimination in risk evaluation, necessitating robust oversight and continual refinement of AI systems. Therefore, while AI enhances risk assessment capabilities, it’s crucial for the insurance industry to strike a balance between innovation and ethical responsibility.

Ethical Implications and Potential Discrimination

The integration of Artificial Intelligence (AI) in the insurance sector presents significant ethical implications, particularly concerning the fairness of risk assessment and the potential for discriminatory practices. The utilization of AI systems can improve efficiency and accuracy in underwriting, yet these advancements also raise serious questions regarding equity. One key concern is that AI algorithms are only as good as the data on which they are trained. If historical data reflects systemic biases—whether based on race, gender, or socioeconomic status—the algorithms may inadvertently perpetuate these disparities in risk evaluations.

For instance, an AI model developed to assess the risk of claims may draw from a dataset where certain demographic groups historically had higher claim rates due to factors unrelated to the actual risk. As a result, individuals from these groups might be unfairly categorized as high-risk clients, facing inflated premiums or denial of coverage altogether. This scenario illustrates a deeper issue regarding algorithmic transparency and accountability. Stakeholders in the insurance sector must scrutinize how data is sourced and how models are built to prevent discriminatory practices that undermine fair access to insurance products.

To address these ethical concerns, regulatory bodies are beginning to establish guidelines that promote equity and fairness in AI applications. These regulations aim to foster responsible data usage, encourage bias mitigation strategies, and bolster audits of AI systems to ensure they operate without unjust discrimination. However, as the technology continues to evolve, the challenge will remain to align AI developments with ethical standards in a way that protects the interests of all consumers, particularly those from historically marginalized communities. Actors within the insurance industry must be vigilant in recognizing these challenges and strive to create a framework that promotes not just technological advancement but also social justice.

The Future of AI in Insurance: Balancing Innovation and Ethics

The landscape of the insurance industry is poised for a significant transformation as artificial intelligence (AI) continues to evolve. The integration of AI in insurance holds great promise for enhancing efficiency and improving the accuracy of risk assessments. However, it simultaneously raises ethical questions that must be addressed to prevent unintended discrimination against various demographic groups. The future of AI in insurance will rely heavily on the balance between innovation and ethical considerations.

Ongoing efforts to refine AI systems focus on increasing fairness and accuracy in risk assessment processes. Industry stakeholders are investing in transparent algorithms that demystify how AI makes decisions. This transparency not only fosters trust among customers but also allows for compliance with upcoming regulations aimed at mitigating bias in automated decision-making systems. By incorporating clear explanations of algorithmic processes, insurers can demonstrate their commitment to ethical practices while leveraging the benefits that AI technology offers.

Moreover, establishing ethical AI frameworks is essential for navigating potential ethical pitfalls. Organizations in the insurance sector are beginning to adopt frameworks that guide the development and deployment of AI systems. These frameworks prioritize fairness, accountability, and inclusiveness, ensuring that algorithms do not perpetuate existing biases or introduce new forms of discrimination. Implementing robust oversight mechanisms will also play a significant role in monitoring AI outputs, allowing insurers to make adjustments as necessary to uphold ethical standards.

As the insurance industry embraces AI, it is crucial to innovate responsibly. This involves ensuring that advancements in technology align with established ethical guidelines, thereby fostering a competitive landscape that prioritizes fairness and inclusivity. By addressing these challenges and integrating ethical considerations into AI development, the insurance sector can move forward confidently, reaping the benefits of AI while safeguarding against potential discrimination.